Price Equity, FX, Commodity, or Energy Instruments

An equity derivative is a contract whose value is at least partly derived from one or more underlying equity, FX, commodity, or energy securities. This toolbox provides functionality to price, compute sensitivity and hedging analysis to many equity securities. You can price vanilla, asian, lookback, barrier, and spread options with pricing models that include lattice models, Monte Carlo simulations, multiple closed-form solutions, and finite differences methods.

The object-based framework supports a workflow for creating instruments, models, and pricer objects to price financial instruments. Using these objects, you can price interest-rate, inflation, equity, commodity, FX, or credit derivative instruments. The object-based workflow is an alternative to pricing financial instruments using functions. Working with modular objects for instruments, models, and pricers, you can easily reuse these objects to compare instrument prices for different models and pricing engines. You can use the object-based workflow to price a single instrument or to price a collection of instruments in a portfolio. For more information on the workflow, seeGet Started with Workflows Using Object-Based Framework for Pricing Financial Instruments.

Create an equity, foreign exchange (FX), or commodity instrument object usingfininstrument, then associate a model usingfinmodel, and then specify a pricing method usingfinpricer.

Functions

Objects

Examples and How To

Price Spread Instrument for a Commodity Using Black-Scholes Model and Analytic Pricers

This example shows the workflow to price a commoditySpreadinstrument when you use aBlackScholesmodel andKirkandBjerksundStenslandanalytic pricing methods.

Price European Vanilla Call Options Using Black-Scholes Model and Different Equity Pricers

This example shows how to compare EuropeanVanillainstrument call option prices using aBlackScholesmodel and different pricing methods.

Use Black-Scholes Model to Price Asian Options with Several Equity Pricers

This example shows how to compare arithmetic and geometric Asian option prices using theBlackScholes模型和各种pricing methods.

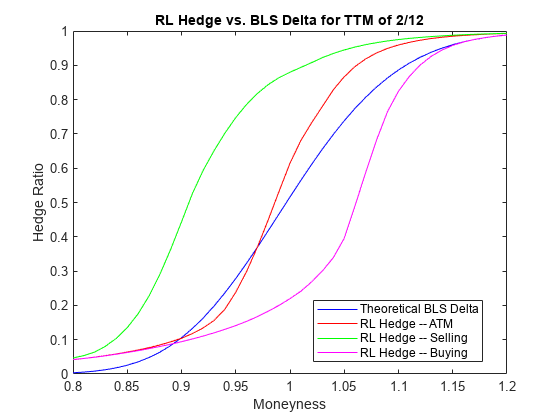

Hedging an Option Using Reinforcement Learning Toolbox

This example shows how to learn an optimal option hedging policy and outperform the traditional BSM approach using Reinforcement Learning Toolbox™ .

Concepts

Get Started with Workflows Using Object-Based Framework for Pricing Financial Instruments

Use objects to model and price financial instruments.

Choose Instruments, Models, and Pricers

Select instruments, associated models, and associated pricers.

The following table lists the interest-rate instrument objects with their associated models and pricers and supportedExercisestyles.

映射函数tions to a workflow using objects for instruments, models, and pricers.