str2doubleq converts text to double like Matlab's str2double,but up to 400x faster! multithreaded.

Matlab connector to IQFeed optimized for reliability, ease-of-use, functionality and performance (including parallelization)

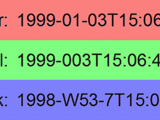

Convert a Date Vector/Number to an ISO 8601 Date String. Tokens control the date/time notation.

Provides functions for getting data from both data sources as well as helper utility functions

Used to retrieve historical stock data for a user-specified date range

Convert an ISO 8601 Date String to Serial Date Numbers. Auto-detect or select the timestamp style.

A standard Cuckoo Search is implemented, which is very efficient. There are three versions now.

(or fit one to a yield curve)

This calculator gives you all the information you need to know while shopping for a mortgage Loan

Generate Matlab table for ticker(s) queried through Alphavantage

Getting Started with Portfolio Optimization (Files for Video Demo)

Version 1.2.0.0

MathWorks Quant TeamFiles for demonstrating how to perform portfolio optimization

VARINDX calculates the variation index and fractal dimension of a financial time series.

Convex versus Concave Management, CPPI, OBPI, portfolio insurance, etc.

Developing a Financial Market Index Tracker using MATLAB OOP and Genetic Algorithms

Version 1.1.0.1

Mark HoyleFiles used in the webinar of the same name

MATS computes many measures of scalar time series analysis on many time series in one go.

Access historical data, real-time market data, place orders, options chains, and more

function getHistoricalIntraDayStockPrice obtains intraday stock price from Google.

it use Machine Learning in MATLAB to predict the buying-decision of Stock by using real life data.

Forecasting the FTSE 100 with high-frequency data: A comparison of realized measures

Version 1.3.0.0

Oleg Komarov我的论文的MSc在金融和经济学from Warwick Business School

Load macroeconomic data from the FRED2 server of the federal reserve bank of St. Louis.

constructs a (non-weighted) maximum cardinality matching

Object-oriented implementations of the Portfo and the Black-Litterman approach

Describe, visualize and model sector risk contagion for a portfolio of securities

MAXIMUM LIKELIHOOD ESTIMATION OF THE COX-INGERSOLL-ROSS PROCESS: THE MATLAB IMPLEMENTATION

Version 1.0.0.0

Kamil KladivkoMaximum Likelihood Estimation of the Cox-Ingersoll-Ross process in Matlab

This Matlab example M-file is to calculate the Complex Hurst for Data like Stock Market.

How to Build an Event-based Automated Trading System in MATLAB

Use ARIMA Model to predict real life stock data

Rotman Trader Toolbox provides functionality for connecting MATLAB(R) to Rotman Interactive Trader

Create fan charts for future asset prices based on sparse call/put price market data.

Full generalization of Black-Litterman and related techniques via entropy pooling

Cumulative Distribution Function of CDO Loan Portfolio Loss in the Gaussian Factor Model

Version 1.0.0.0

Pavel OkunevComputes Cumulative Distribution Function of CDO Loan Portfolio Loss in the Gaussian Factor Model

Demo files from (upcoming) webinar on Machine Learning for Algo Trading

Retrieves historical stock data from Yahoo Finance by parsing html pages instead of .csv download.

A framework for systemic risk valuation and analysis.

Engineering Optimization: An Introduction with Metaheuristic Applications

Version 1.0.0.0

Xin-She YangPSO, Firefly Algorithm

A simple Monte Carlo simulation example with detailed comments

Compute autocorrelation function

text and comments on solutions available at http://symmys.com/node/170

Calculates option prices for the Heston stoch. vol. model and illustrates the parameter sensitivity.

Function to smooth call option prices and implied volatilities free of static arbitrage.

discrete-time and continuous-time processes for finance, theory and empirical examples

Markowitz Portfolio Optimization

Sum-Product Algorithm Applied to HMM

Estimation value at risk by using Exponentially Weighted Moving Averagege

Version 1.1.0.0

Ali NajjarEstimating Value at Risk of portfolio by using Exponentially Weighted Moving Average

Multiple Complex Moving Average Calculations

Estimating VaR

Plots the Volatility Surface from the Implied Volatility obtained from puts and calls.

(via an interactive GUI)

Regression & Classification Prediction for House Price Download from Github: https://github.com/KevinChngJY/house_price_prediction

As introduced by Vickery (1961), Bertsekas (1979) refined by Demange, Gale, Sotomayor (1980's).

实时交易演示和介绍,提出了NYC Computational Finance Conference 23 May 2013

This is a simple function that calculates the VaR using the Geometric Brownian Motion

This function gets the list of symbols for stocks from indices and/or sectors.

Carr-Madan and Lewis pricing methods using FFT for many advanced financial models

The script downloads 10 years of stock data from Yahoo Finance.

Pricing functions for selected options with alternative methods

Calculates the end indices of 90 different candlestick patterns

This BTC-e trade api can be used to automatically trade on btc-e using their api.

This code uses rolling window FIGARCH model estimates to compute forecasts.

Bootstrap the yield curve, discount curve and forward curve from bond market prices. Plot results.