frontcon.迁移到投资组合对象

迁移frontcon.没有输出参数

此示例显示了如何迁移frontcon.没有输出参数到投资组合对象。

基本frontcon.功能表示为:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; frontcon(ExpReturn, ExpCovariance, NumPorts);

未定义的功能或变量'frontcon'。

迁移A.frontcon.没有输出参数到Portfolio对象的语法:

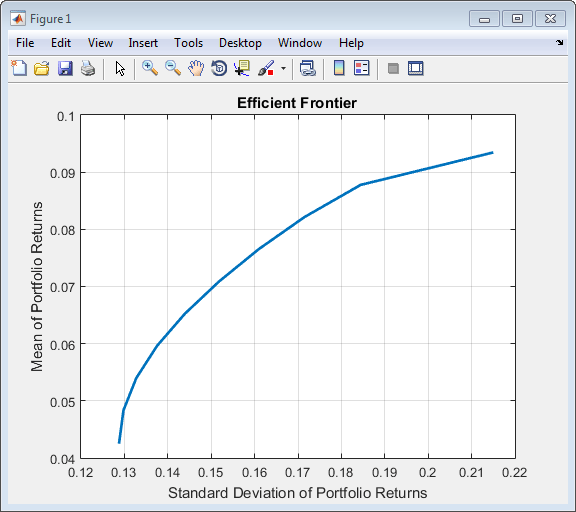

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; p = Portfolio; p = setAssetMoments(p, ExpReturn, ExpCovariance); p = setDefaultConstraints(p); plotFrontier(p, NumPorts);

投资组合对象写入当前的图形窗口,而不是每次生成绘图时创建新窗口。

迁移frontcon.输出参数

此示例显示了如何迁移frontcon.输出参数到投资组合对象。

基本frontcon.功能表示为:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; [PortRisk, PortReturn, PortWts] = frontcon(ExpReturn, ExpCovariance, NumPorts); display(PortWts);

未定义的功能或变量'frontcon'。

迁移A.frontcon.带有输出参数的语法:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; p = Portfolio; p = setAssetMoments(p, ExpReturn, ExpCovariance); p = setDefaultConstraints(p); PortWts = estimateFrontier(p, NumPorts); [PortRisk, PortReturn] = estimatePortMoments(p, PortWts); display(PortWts);

PortWts = 0.2103 0.1744 0.1386 0.1027 0.0668 0.0309 0 0 0 0 0.2746 0.2657 0.2567 0.2477 0.2387 0.2298 0.2168 0.1791 0.0557 0 0.1157 0.1296 0.1436 0.1575 0.1714 0.1854 0.1993 0.2133 0.2183 0 0.1594 0.2193 0.2791 0.3390 0.3988 0.4587 0.5209 0.5985 0.7260 1.0000 0.2400 0.2110 0.1821 0.1532 0.1242 0.0953 0.0629 0.00910 0.

Portfolio对象返回portwts.投资组合是列向下的,而不是行向下的。投资组合的风险和回报仍以列的形式显示。

迁移frontcon.对于目标返回,在高效的投资组合返回范围内

此示例显示了如何迁移frontcon.目标在高效的投资组合范围内返回到投资组合对象。

frontcon.可以获得具有特定目标返回级别的投资组合,但要求目标退货落在有效的回报范围内。POSTFOLIO对象通过在高效前沿的末端选择投资组合来处理这一点。

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; TargetReturn = [ 0.05; 0.06; 0.07; 0.08; 0.09 ]; [PortRisk, PortReturn, PortWts] = frontcon(ExpReturn, ExpCovariance, [], TargetReturn); disp('有效目标');DISP([Portryurn,TargetReturn]);

未定义的功能或变量'frontcon'。

迁移A.frontcon.在portfolio对象的有效portfolio返回范围内的目标返回语法:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; TargetReturn = [ 0.05; 0.06; 0.07; 0.08; 0.09 ]; p = Portfolio; p = setAssetMoments(p, ExpReturn, ExpCovariance); p = setDefaultConstraints(p); PortWts = estimateFrontierByReturn(p, TargetReturn); [PortRisk, PortReturn] = estimatePortMoments(p, PortWts); disp('有效目标');DISP([Portryurn,TargetReturn]);

高效目标0.0500 0.0500 0.0600 0.0600 0.0700 0.0700 0.0800 0.0800 0.0900 0.0900

迁移frontcon.对于目标返回的范围,高效的投资组合返回

此示例显示了如何迁移frontcon.目标返回在高效的投资组合范围之外返回到投资组合对象。

当目标回报超出有效投资组合回报的范围时,frontcon.生成一个错误。Portfolio对象通过在有效边界的末端选择投资组合来有效地处理这个问题。

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; TargetReturn = [ 0.05; 0.06; 0.07; 0.08; 0.09; 0.10 ]; [PortRisk, PortReturn, PortWts] = frontcon(ExpReturn, ExpCovariance, [], TargetReturn); disp('有效目标');DISP([Portryurn,TargetReturn]);

未定义的功能或变量'frontcon'。

迁移A.frontcon.目标返回的目标返回范围的返回范围返回到投资组合对象:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; TargetReturn = [ 0.05; 0.06; 0.07; 0.08; 0.09; 0.10 ]; p = Portfolio; p = setAssetMoments(p, ExpReturn, ExpCovariance); p = setDefaultConstraints(p); PortWts = estimateFrontierByReturn(p, TargetReturn); [PortRisk, PortReturn] = estimatePortMoments(p, PortWts); disp('有效目标');DISP([Portryurn,TargetReturn]);

警告:一个或多个目标返回值超出可行范围[0.0427391,0.0934]。将返回与这些值范围的终点相关联的投资组合。>在投资组合/ estismsFryierByRebreturn(106号线)高效目标0.0500 0.0600 0.0600 0.0700 0.0700 0.0800 0.0900 0.0900 0.0900 0.0900 0.0900

迁移frontcon.使用界限时的语法

此示例显示了如何迁移frontcon.语法assetbounds.到投资组合对象。

使用frontcon.输入规范assetbounds.它包含了投资组合中分配给每个资产的权重的上下限:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; AssetBounds = [ 0.1, 0.1, 0.1, 0.1, 0.1; 0.5, 0.5, 0.5, 0.5, 0.5 ]; [PortRisk, PortReturn, PortWts] = frontcon(ExpReturn, ExpCovariance, NumPorts, [], AssetBounds); disp([PortRisk, PortReturn]);

未定义的功能或变量'frontcon'。

迁移A.frontcon.语法使用assetbounds.到投资组合对象:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; AssetBounds = [ 0.1, 0.1, 0.1, 0.1, 0.1; 0.5, 0.5, 0.5, 0.5, 0.5 ]; LowerBound = AssetBounds(1,:); UpperBound = AssetBounds(2,:); p = Portfolio; p = setAssetMoments(p, ExpReturn, ExpCovariance); p = setDefaultConstraints(p); p = setBounds(p, LowerBound, UpperBound); PortWts = estimateFrontier(p, NumPorts); [PortRisk, PortReturn] = estimatePortMoments(p, PortWts); disp([PortRisk, PortReturn]);

0.1288 0.0427 0.1291 0.0457 0.1299 0.0487 0.1313 0.0516 0.1332 0.0546 0.1356 0.0576 0.1385 0.0605 0.1385 0.0605 0.1119 0.0635 0.11. 0.0665 0.1119 0.0665 0.1119 0.0690

迁移frontcon.使用组时的语法

此示例显示了如何迁移frontcon.语法团体和群群到投资组合对象。

使用frontcon.输入规范团体(资产群体或课程。)和群群(组中所有资产总重量的下限和上限)。考虑三组:资产2,3和4可以构成投资组合的80%,资产1和2可占投资组合的高达70%,而资产3,4和5可以构成高达90%的资产一个投资组合。

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; Groups = [ 0 1 1 1 0; 1 1 0 0 0; 0 0 1 1 1 ]; GroupBounds = [ 0, 0.8; 0, 0.7; 0, 0.9 ]; [PortRisk, PortReturn, PortWgts] = frontcon(ExpReturn, ExpCovariance, NumPorts, [], [],......团体,群群体);DISP([Portrack,Portryurn]);

未定义的功能或变量'frontcon'。

迁移A.frontcon.语法使用团体和群群到投资组合对象:

= [0.0054;0.0531;0.0779;0.0934;0.0130);ExpCovariance = [0.0569, 0.0092, 0.0039, 0.0070, 0.0022;0.0092, 0.0380, 0.0035, 0.0197, 0.0028;0.0039、0.0035、0.0997、0.0100、0.0070;0.0070, 0.0197, 0.0100, 0.0461, 0.0050;0.0022, 0.0028, 0.0070, 0.0050, 0.0573]; NumPorts = 10; Groups = [ 0 1 1 1 0; 1 1 0 0 0; 0 0 1 1 1 ]; GroupBounds = [ 0, 0.8; 0, 0.7; 0, 0.9 ]; LowerGroup = GroupBounds(:,1); UpperGroup = GroupBounds(:,2); p = Portfolio; p = setAssetMoments(p, ExpReturn, ExpCovariance); p = setDefaultConstraints(p); p = setGroups(p, Groups, LowerGroup, UpperGroup); PortWts = estimateFrontier(p, NumPorts); [PortRisk, PortReturn] = estimatePortMoments(p, PortWts); disp([PortRisk, PortReturn]);

0.1288 0.0427 0.1292 0.0465 0.1306 0.0503 0.1328 0.0540 0.1358 0.0578 0.1395 0.0515 0.1440 0.0653 0.0690 0.1590 0.0728 0.0653 0.060 0.0728 0.0653 0.0690 0.1150 0.0728 0.0653 0.060 0.060 0.1590 0.0728 0.1806 0.070

另请参阅

addInequality|estismsfrontier.|estismsfrontierbyreturn.|estibalportmoments.|Pcalims.|PCGComp.|PCGLIMS.|波特诗|投资组合|portopt.|setAssetMoments|setBound.|setDefaultConstraints.|集团|setInequality